Efilling Income Tax Return Efiling for AY 2020-21 fy 2019-20 https://www.incometaxindiaefiling.gov.in

Efilling Income Tax Return Efiling for AY 2020-21 fy 2019-20 https://www.incometaxindiaefiling.gov.in

Efilling for Income tax Return online for assesment year 2020-21 and financial year 2019-20 started at Income tax Department Official website https://www.incometaxindiaefiling.gov.in Many Taxpayer waiting to Filling their Income tax Return Online for Ay 2020-21 Income tax Return Online for fy 2019-20. now all Tax payer Can fill up their Income tax return Online for AY 2020-21.

Here In this Article we Gives all the Detail to fill up Income tax Return Online for Ay 2020-21 and Income tax Return for FY 2019-20.

How To Efilling Income TAx Return for FY 2019-20 ?

To Efilling Income TAx Return Online for AY 2020-21 follow the following steps.

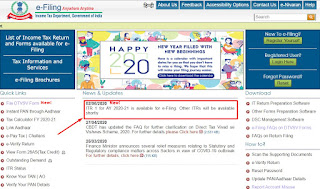

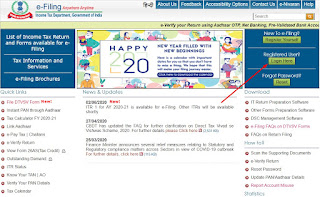

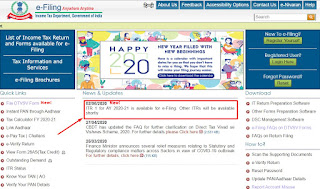

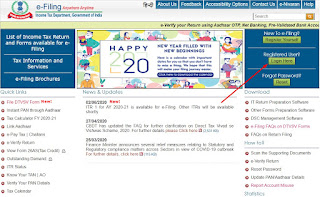

1. First Open Efilling Income Tax Department Official website https://www.incometaxindiaefiling.gov.in You can open Direct from here. Here you can see that Income Tax Department Put notification for Efilling Income tax form Start for Ay 2020-21 and 2019-20.

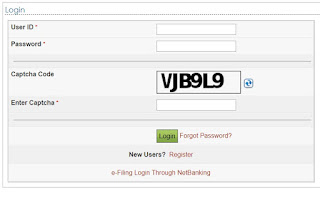

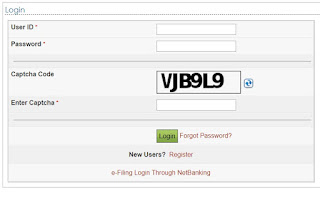

2. Then You have to Login ti Efilling Income tax Return Online for AY 2020-21. If you have Registered user of Efilling site you can Login via User id and password.

If you are not Registered User you have to first Registered on Income Tax Department Efilling site.

3.If you have Registered user of Efilling site you can Login via User id and password. Here User id is your PAN no. If you forget your Efilling password you can use Forget password option.

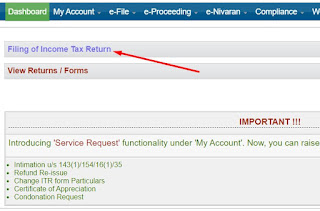

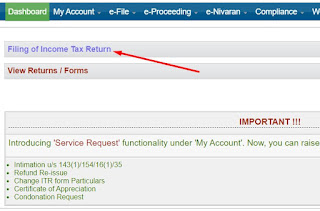

4. After Login on Efilling Site You can get various Option on it. Like Dashboard, My account, and other option. now you have to Select " Filling Of Income Tax Return" Tab.

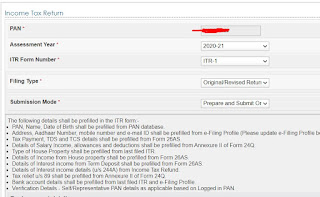

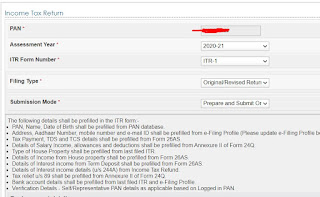

5. After Select " Filling Of Income Tax Return" Tab. You have See New Welcome box Like Below Screenshot. You have to select

Assessment year 2020-21

ITR Form Number: ITR-1

and also fill up other option

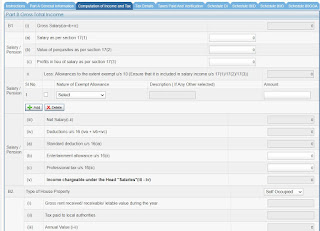

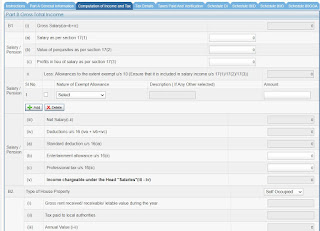

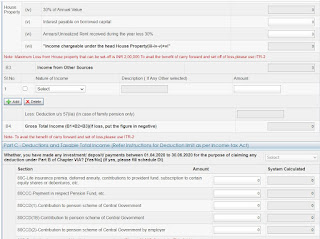

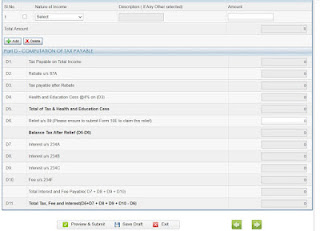

6. Now open The Income Return Online form for AY 2020-21 and Income Return Online form for FY 2019-20. You can see various Tab Like

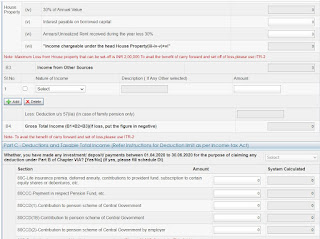

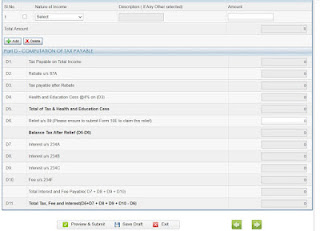

and Put your All Date of Income and Deduction for FY 2019-20 Under "computation of Income and Tax" Tab.

Pleade Fill up all Data carefully In this Form.

After Fill up all data. you have to check Ones again all info. giver by you are correct or not.

Then Submit your Form.

Then you have 2 option for Varification of data.

1. Print Receipt and sent it via post to CPC Bangaluru

Or

2. E varify via your adhar no

Thanks.

we hope that we have given all the necessory steps to Efilling Income tax return Online for Ay 2020-21.

Efilling for Income tax Return online for assesment year 2020-21 and financial year 2019-20 started at Income tax Department Official website https://www.incometaxindiaefiling.gov.in Many Taxpayer waiting to Filling their Income tax Return Online for Ay 2020-21 Income tax Return Online for fy 2019-20. now all Tax payer Can fill up their Income tax return Online for AY 2020-21.

Here In this Article we Gives all the Detail to fill up Income tax Return Online for Ay 2020-21 and Income tax Return for FY 2019-20.

- Efilling Income tax Return

- Income tax Return for AY 2020-21

- Income tax Return for FY 2019-20

- Online Income tax Return file

- Guide To Filling Income Tax Return

How To Efilling Income TAx Return for FY 2019-20 ?

To Efilling Income TAx Return Online for AY 2020-21 follow the following steps.

1. First Open Efilling Income Tax Department Official website https://www.incometaxindiaefiling.gov.in You can open Direct from here. Here you can see that Income Tax Department Put notification for Efilling Income tax form Start for Ay 2020-21 and 2019-20.

2. Then You have to Login ti Efilling Income tax Return Online for AY 2020-21. If you have Registered user of Efilling site you can Login via User id and password.

If you are not Registered User you have to first Registered on Income Tax Department Efilling site.

3.If you have Registered user of Efilling site you can Login via User id and password. Here User id is your PAN no. If you forget your Efilling password you can use Forget password option.

4. After Login on Efilling Site You can get various Option on it. Like Dashboard, My account, and other option. now you have to Select " Filling Of Income Tax Return" Tab.

5. After Select " Filling Of Income Tax Return" Tab. You have See New Welcome box Like Below Screenshot. You have to select

Assessment year 2020-21

ITR Form Number: ITR-1

and also fill up other option

6. Now open The Income Return Online form for AY 2020-21 and Income Return Online form for FY 2019-20. You can see various Tab Like

- Instructions

- General Instructions

- Computation Of Income and Tax

- Tax Details

- TAxes paid and varifications

- And other options.

and Put your All Date of Income and Deduction for FY 2019-20 Under "computation of Income and Tax" Tab.

Pleade Fill up all Data carefully In this Form.

After Fill up all data. you have to check Ones again all info. giver by you are correct or not.

Then Submit your Form.

Then you have 2 option for Varification of data.

1. Print Receipt and sent it via post to CPC Bangaluru

Or

2. E varify via your adhar no

Thanks.

we hope that we have given all the necessory steps to Efilling Income tax return Online for Ay 2020-21.